travel nurse salary taxes

For travelers stipends are tax-free when they are used to cover duplicated expenses such as lodging and meals and do not have to be reported as taxable income. What is a tax home.

How Much Do Travel Nurses Make Nursejournal Org

If there are any unanswered questions please consult a Tax Professional.

. These reimbursements or stipends can be tax free with proof of an official tax home in your home state and duplication of expenses. Chapter 1 A Saga of How It Started. However recently-licensed travel nurses tend to earn a much lower starting salary of 3771 while their more experienced counterparts earn an average of 8206.

12 for taxable income between 9876 and 40125. Have a permanent physical residence that you pay for and maintain. You can also be part of the tax advantage plan in which some expenses are tax-deductible and some are non-taxable.

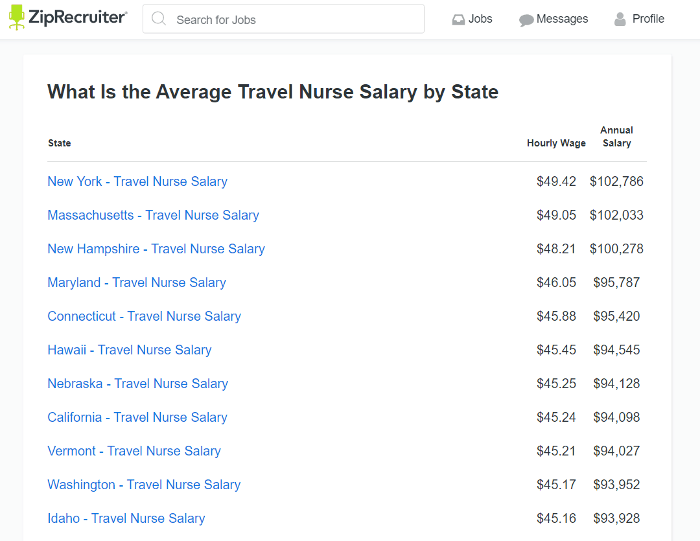

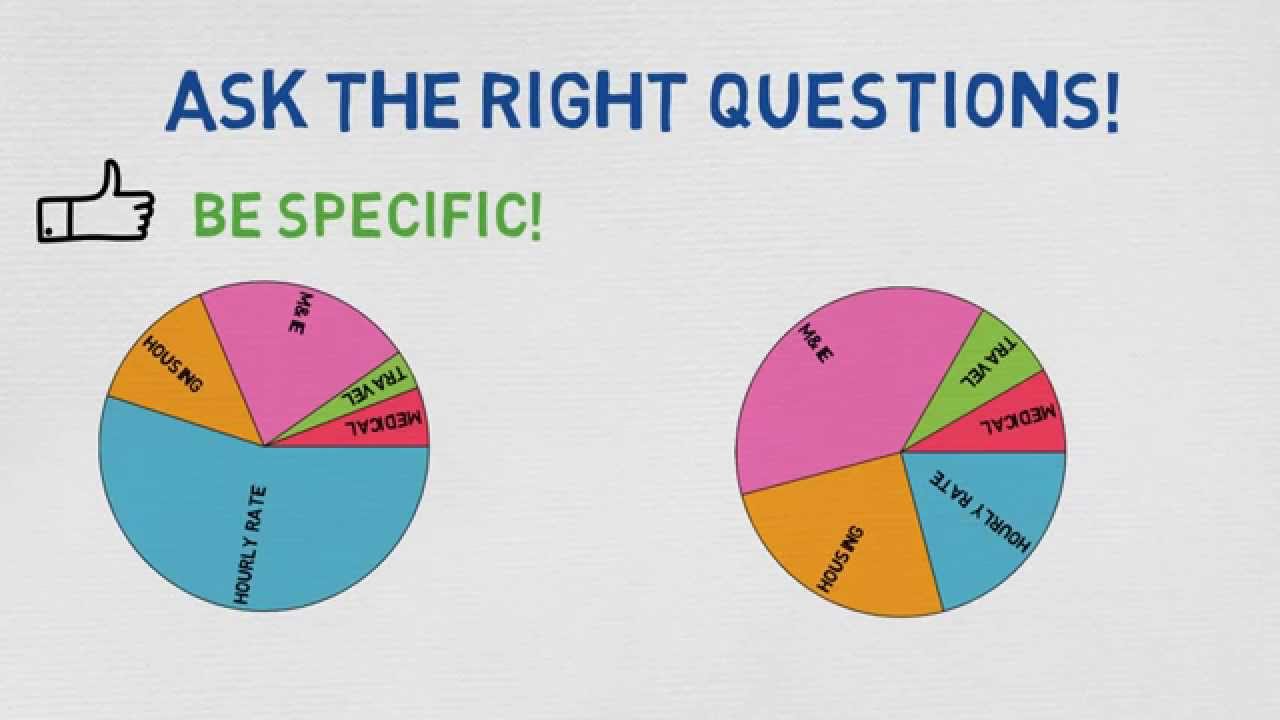

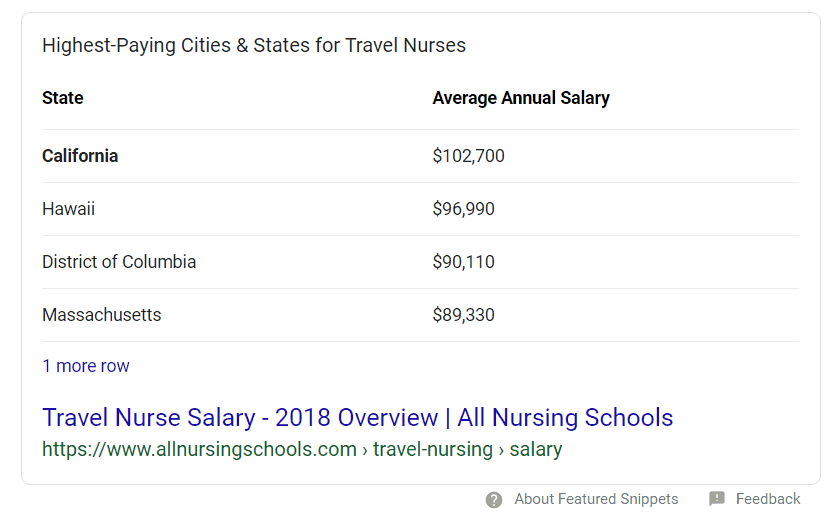

The average hourly rate for a travel nurse is 5649. Typically Travel Nurses receive a lower base pay than permanent Pros with the difference made up by non-taxable reimbursements. As you interview for and are offered travel nursing jobs pay close.

Im only going to address the issue of tax-free stipends aka per diems the IRS kind not the nurse shift kind for nurses who maintain and pay for another residence while temporarily on travel assignment. This is the most common Tax Questions of Travel Nurses we receive all year. 500 for travel reimbursement non-taxable.

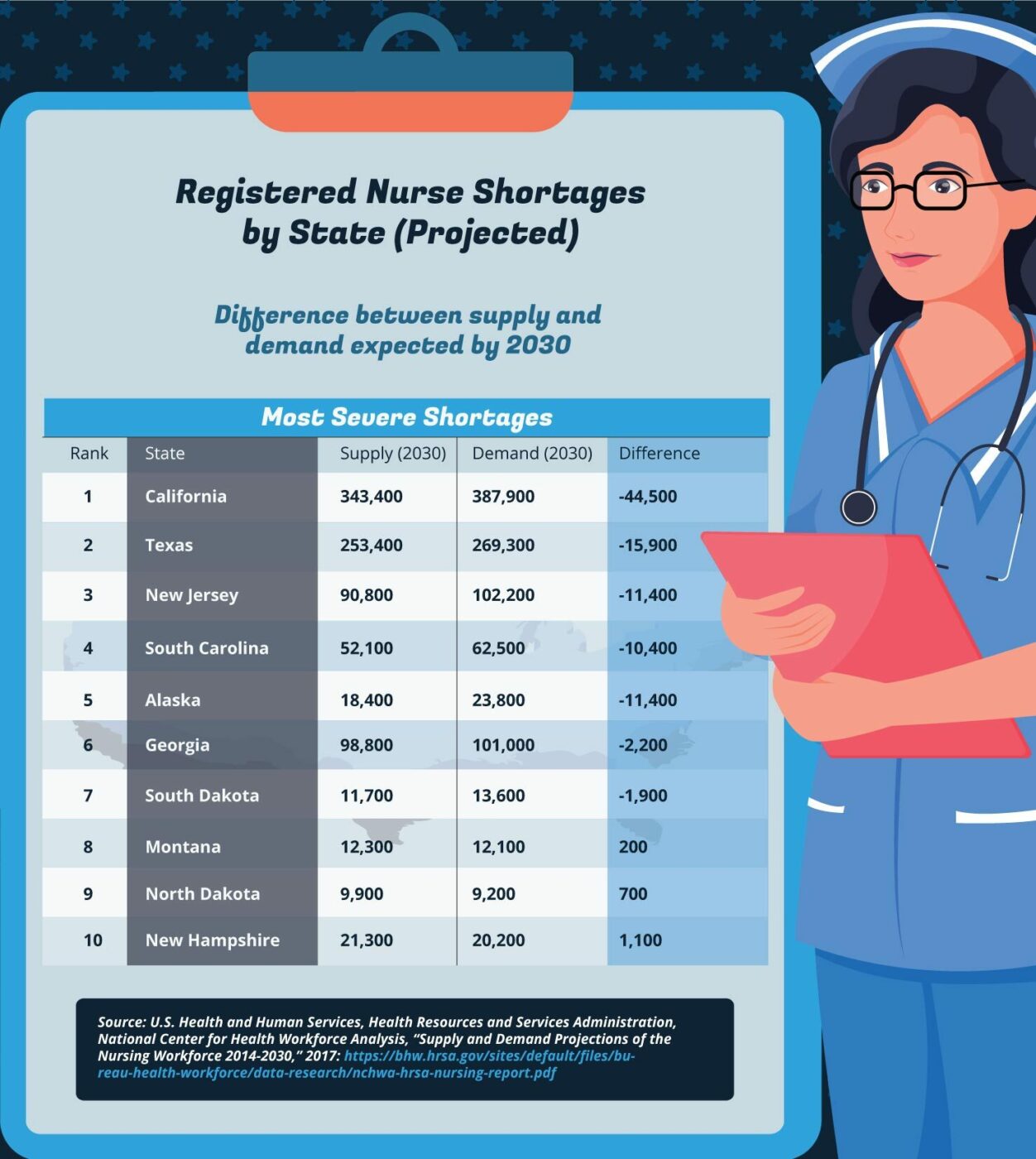

Purveyors of this rule claim that it allows travel nurses to accept tax-free. Bureau of Labor and Statistics BLS travel nurses earn just over 51 an hour on average while RNs earn just under 3850 an hour. When doing proactive planning Willmann says its important to pay attention to your marginal tax rate.

Travel Nursing Pay The 50 Mile Myth for Tax Free Stipends. Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees.

The regular taxable hourly rate plus nontaxable reimbursements also called stipends subsidies allowances or per diem payments which are meant to cover meals and lodging. It is also the most important since the determination of whether per diems stipends allowances or subsidies are taxable. Because Travel Nursing makes filing taxes more complex however the IRS is usually lenient.

10 for the first 9875 in taxable income. Chapter 4 Dough Pesos Loot The Almighty Dollar. Travel nurses who are W-2 employees will pay taxes just like they would back home.

The higher earning potential of travel nursing in relation to tax advantages can seem like a no-brainer. Chapter 2 Are You Meant to Be a Travel Nurse. State travel tax for Travel Nurses.

In this Travel Nursing Tax Guide we will cover. The base rate is taxable but the reimbursements or allowances may be tax-exempt if youre working away from your tax home. For more on travel nursing salaries check out Salary Explorer.

Some of this may include overtime hours though the availability and demand for overtime will vary from one assignment to. As mentioned above we simply subtract the estimated weekly taxes from the weekly taxable wage and add the remainder to the total weekly tax-free stipends to calculate weekly net pay for a contract. Due to the tax law changes back in 2018 you cant take any travel expense deductions.

You must have regular employment in the area. One of the many incentives medical companies may use to entice traveling nurses is through the use of per diems wages paid for daily living expenses such as food gas or other basic expenses. Your hourly wages are taxable but these per diems are not.

This is because travel nurses are paid a base hourly rate that is taxable and a weekly travel stipend that is not taxable both of which equal their total pay in a given contract. Resources on tax rules for travelers and some key points. The tax implications and filing.

The History of Travel Nursing. Chapter 5 Travel Nursing Assignments. 250 per week for meals and incidentals non-taxable.

Chapter 3 Travel Nurse Schooling. This Travel nurse Tax Guide is only a guide. There is no possibility of negotiating a higher bill rate based on a particular travel nurses salary history or work experience.

Others can read this sites handy advice. Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to see 20-30000 of non-tax. This means travel nurses can no longer deduct travel-related expenses such as food.

These stipends and reimbursements are for expenses such as meals parking transportation fees and housing. To claim the tax benefits of being a travel nurse your tax home must fit these requirements. 1099 employees expecting to owe over 1000 in taxes have to file and pay taxes quarterly whereas W2 employees have taxes withheld every pay period but only have to file annually.

22 for taxable income between 40126 and 85525. If the travel nurse does not have a tax residence the reimbursement portion is supposed to be. This is how a lot of travel nurses handle taxes.

However your employer is allowed to pay an employee travel nurse a. These practitioners can earn 1840-6340 per week averaging a 36-hour work week. 24 for taxable income between 85526 and 163300.

Travel nurses on the other hand receive a base rate and a reimbursement or an allowance for housing food and other travel expenses. Yet a travel nurses pay generally consists of two main components. Travel Nursing Pros and Cons.

The 50 Mile Rule is one of the most common fallacies pertaining to tax-free reimbursements for travel nurses. 1 A tax home is your main area. You will owe both state where applicable and federal taxes like everyone else.

I could spend a long time on this but here is the 3-sentence definition. Not just at tax time. Chapter 6 Finding Your.

2000 a month for lodging non-taxable. Its prominent among both travel nurses and travel nursing recruiters. If you worked 50 out 52 weeks in 2021 and your base pay hourly rate was 67 and your weekly travel stipend was 1085 you would have a total.

Thats the tax rate on one more dollar of. Traditional full-time nurses receive a taxable salary from a single employer. Travel Nurse Tax Deductions such as Tax-Free Stipends and Reimbursements Tax Homes Reasons for Taxable Income and Tips to pay less tax and decrease any chance of an audit.

According to Vivian a healthcare jobs marketplace and the US. Find a Job Land a Job and Keep a Job. Spend at least 30 days of the year in that place.

Typically there are stipends or reimbursements for travel nurses. Your blended rate is calculated by breaking down your non-taxable stipends into an hourly. Here is an example of a typical pay package.

For Sample 1 were looking at 720 16759 55241 68846 124087 net weekly pay. 20 per hour taxable base rate that is reported to the IRS.

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

How To File Your Taxes As A Travel Nurse Ioogo

Travel Nurse Salary Comparably

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

What Is Travel Nursing Academia Labs

Trusted Event Travel Nurse Taxes 101 Youtube

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Travel Nurse Tax Deductions What You Need To Know For 2018

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

How To Make The Most Money As A Travel Nurse

How Much Do Travel Nurses Make Factors That Stack On The Cash

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

How Long Can A Travel Nurse Stay In One Place Bluepipes Blog